Rocket Money

Rethinking support at scale: How Rocket Money operationalized AI

Rocket Money is a leading personal finance app that supports millions of users on their financial journeys – from managing subscriptions, to tracking spending, and reaching savings goals. As the company scaled, so did the volume and complexity of support. But instead of simply hiring more agents, the team saw an opportunity to do things differently.

In 2024, Rocket Money began rethinking how customer service should operate in an AI-enabled world. They introduced Fin, an AI Agent designed for customer support, and what started as a controlled experiment quickly became a new operating system for support – one that balances automation with transparency, and scale with trust.

“We wanted a system that could support customers reliably, at scale, and still feel personal because we recognize our customers’ financial journeys are deeply personal.”

“We wanted a system that could support customers reliably, at scale, and still feel personal because we recognize our customers’ financial journeys are deeply personal.”Today, Fin is involved in over half of all conversations and resolves 68% of them, which amounts to tens of thousands each month. More importantly, it’s reshaped how the team works: manual triage has been eliminated, new AI-focused roles are emerging, and human CSAT has risen by six points.

“We didn’t want to automate just for efficiency,” says Michelle McGowan, Director of Operations. “We wanted a system that could support customers reliably, at scale, and still feel personal because we recognize our customers’ financial journeys are deeply personal.”

This is a story of how a Financial Services company rebuilt its support model from the ground up – shifting how their team works, and proving that automation can be both efficient and trusted.

Rocket Money’s product touches sensitive parts of a user’s financial life, so support has to be fast, accurate, and deeply reliable.

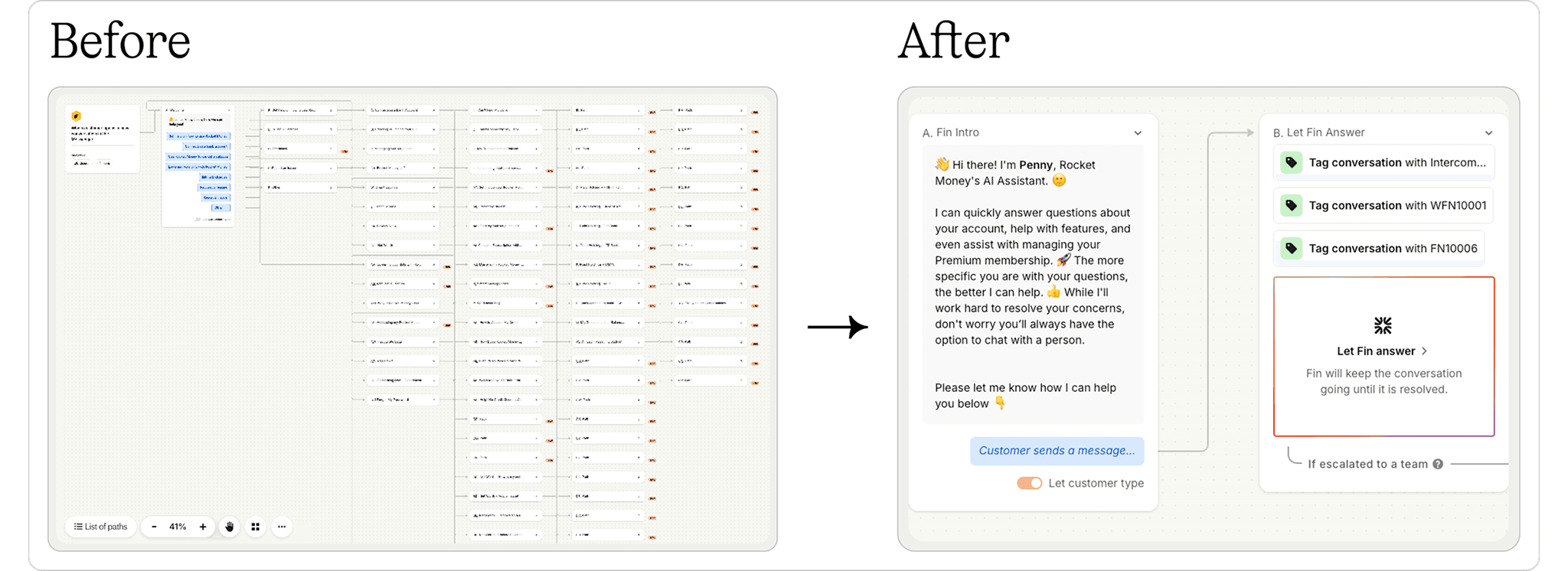

As the customer base grew, so did the complexity of support. The team was handling over 60,000 conversations each month, relying heavily on button-based workflows to route requests. These flows were well-intentioned and thoughtfully built, but they placed the burden of precision on the customer. If someone clicked the wrong path, their conversation landed in an “Unassigned” inbox, where a teammate had to manually interpret and redirect it.

“It created extra work for customers and for us,” states Michelle. “And we realized that no matter how well we tried to design those flows, we were never going to be able to predict every situation.”

At the peak of the problem, one teammate was spending two to three hours a day manually rerouting conversations. The work mattered, but it wasn’t sustainable.

It was clear the model needed to evolve.

The team started small, introducing Fin, Intercom’s AI Agent, into just 10% of conversations. From there, they expanded to key workflows that could be clearly scoped and carefully controlled, like billing management, app troubleshooting, and account access requests.

“Every step of the rollout was deliberate. We tested, we measured, and we made sure the experience was up to our standard before we expanded.”

“Every step of the rollout was deliberate. We tested, we measured, and we made sure the experience was up to our standard before we expanded.”Some of Rocket Money’s most common support needs are also the most sensitive, so every workflow was tested and monitored closely. Routing rules and logic paths were built to ensure Fin only handled queries it was equipped to resolve, and that high-risk or sensitive issues were escalated immediately.

“Every step of the rollout was deliberate,” notes Michelle. “We tested, we measured, and we made sure the experience was up to our standard before we expanded.”

Within months, Fin was handling more than half of all conversations and resolving 68% of them. In areas like email-based billing management, Fin was not just matching human performance – it was exceeding it, consistently delivering 80%+ CSAT.

The operational impact was significant. Manual triage was greatly reduced, average handle times dropped, and the team unlocked nearly $1M in annual efficiency gains.

As Fin took on more of the high-volume, repeatable work, Rocket Money's human support team had space to evolve.

Human agents who once spent hours manually rerouting conversations, now focus on optimizing Fin: refining workflows, identifying edge cases, and improving how Fin handles exceptions. Rocket Money is looking to hire a full-time Knowledge Manager to support Fin’s continued growth and ensure the underlying knowledge that powers it is always accurate and up to date.

“This is what a modern support team looks like,” says Michelle. “It’s not about removing humans. It’s about redesigning the work so humans are focused where they add the most value.”

While Fin handles the initial interaction and many common queries, humans remain essential. They step in when oversight or escalation is the best path forward. And because their time is no longer spent on routine tasks, they’re better equipped to handle those moments with care.

“This is the work people want to be doing. It’s more creative, more impactful, and more fulfilling.”

“This is the work people want to be doing. It’s more creative, more impactful, and more fulfilling.”The shift hasn’t just improved efficiency. It’s made the work more meaningful. Agent morale has improved, human CSAT has increased by six points, and the team now has the time and focus to tackle more strategic challenges.

“This is the work people want to be doing,” Michelle notes. “It’s more creative, more impactful, and more fulfilling.”

Rocket Money is building a new operational model where AI is embedded into the foundation of support, not added on top.

With the AI Agent now managing a large share of incoming volume, the team is investing in infrastructure to scale safely. They’re refining routing logic, expanding the actions that Fin can take, and building internal knowledge systems that make both AI and human teammates more effective.

The focus is on long-term sustainability. That means designing clear handoffs between Fin and humans, ensuring oversight on sensitive workflows, and giving the team time to improve the system continuously.

AI is not a project. It’s a capability. And Rocket Money is building the systems, roles, and practices to support it for the long term.