MONY Group

Scaling smart in a regulated world: Inside MONY Group's AI transformation

As a leader in the UK's financial technology sector, MONY Group is the driving force behind household names like MoneySuperMarket, MoneySavingExpert, and Quidco. Its core mission is to help households make the most of their money, empowering millions of people daily to find better deals on everything – from insurance and credit to household utilities. In this tightly regulated environment where trust matters most, the support team is the first line of clarity and confidence – helping customers feel confident as they navigate these important financial decisions.

But with high volumes, rising pressure, and a growing risk of burnout, the team was stretched thin. They were handling more than 25,000 conversations a month, in a regulated environment where every detail had to be right. At the same time, customer expectations were changing fast, and Zendesk, their existing customer service solution, lacked the automation and flexibility to keep up. So the team went in search of a more automated way to deliver real-time support, meet rising volumes, and give their team the space to focus on more meaningful work.

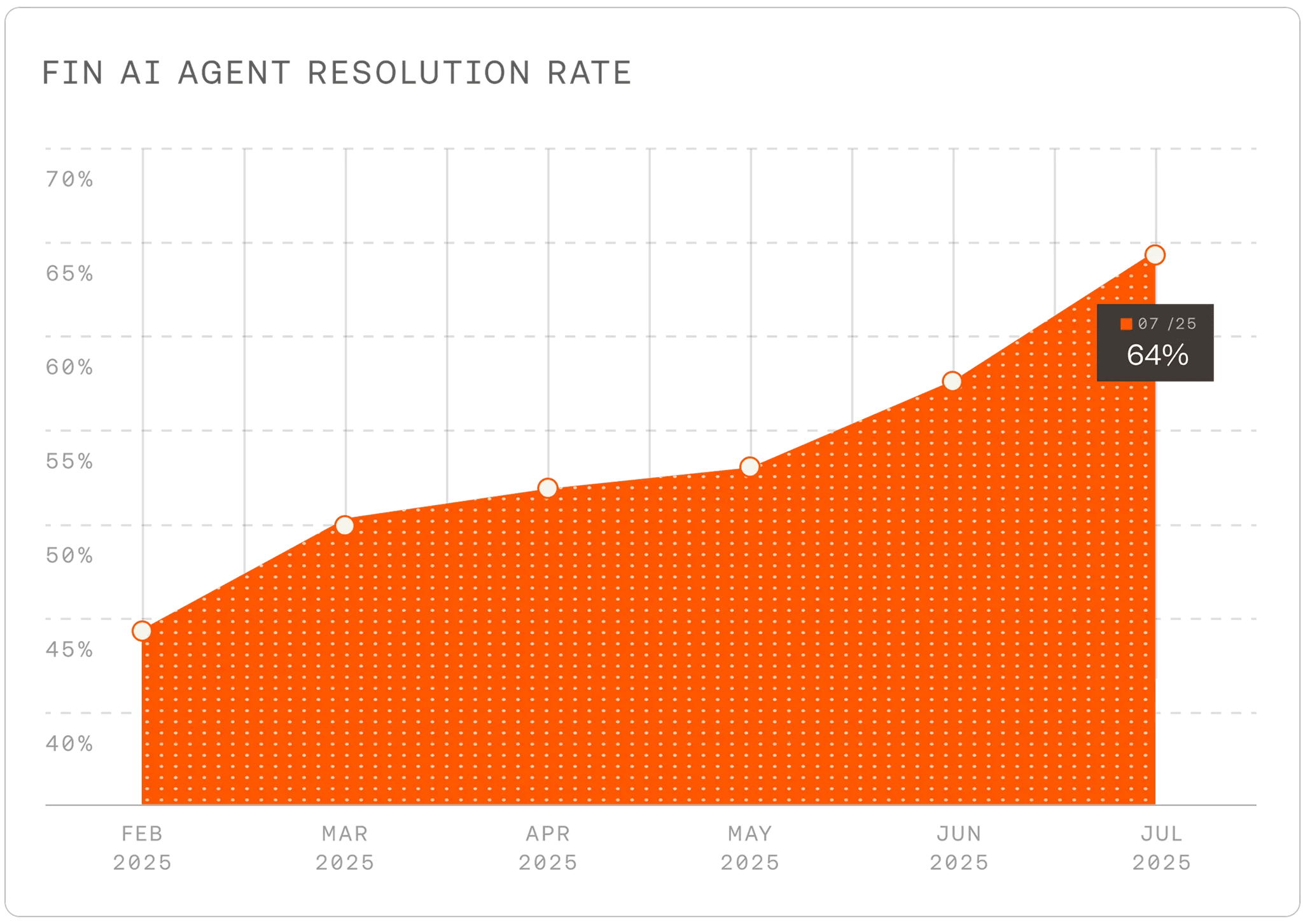

That’s when they made the switch to Intercom and rolled out Fin, an AI Agent for customer service. Today, Fin is at the center of support for MoneySuperMarket and Quidco – resolving 64% of queries across chat and email, including complex questions around reward eligibility and cashback claims. And it’s doing it all with the accuracy, control, and confidence a regulated business demands.

Before switching to Intercom and rolling out Fin, MONY Group’s support team was navigating two major challenges:

1. Rising support volumes

The team was managing over 25,000 conversations a month. Many were repetitive, taking up time that could have gone toward more complex or sensitive queries. The relentless volume meant the team was constantly treading water, at risk of burnout. “We were stuck answering the same questions over and over,” says Lee Burkhill, Project Manager at MONY Group. “We were never hitting zero on the MoneySuperMarket team. There was always a queue waiting.”

And in a regulated industry with strict compliance requirements from bodies like the FCA and Ofgem, even the simplest questions required careful handling.

The strategic goal was clear: relieve the pressure from the team without risking compliance and create capacity. This was never about reducing headcount, it was about protecting and empowering a team of experts to do their best work.

2. Shifting customer expectations

At the same time, customer behavior had changed. People no longer wanted to wait for replies over email or phone. They expected answers right away and in a channel that felt fast, simple, and human. That shift accelerated with the launch of the Super Save Club – a new rewards platform offering cashback and free day-out passes for purchases made through MoneySuperMarket. This drew in a broader audience and more transactional queries, many of which were time-sensitive and volume-heavy.

Zendesk wasn’t built for real-time conversations or the pace customers now expected. “Customers were expecting quick answers and new ways to get help, and we just couldn’t deliver that with our existing setup. Zendesk wasn’t flexible enough to keep up,” Lee shares.

The team needed a new solution that could handle complexity at scale and meet customers where they were. They knew AI would play a key role – but it had to be safe, compliant, and trustworthy. So they went in search of a powerful AI Agent that could help them scale without risking compliance.

1. Finding the right AI solution for a regulated industry

MONY Group evaluated a range of tools, including Zendesk’s own AI. The criteria were clear: strong performance, full control, ability to scale across channels, and safety. Any solution had to meet their compliance standards and operate reliably in a regulated environment.

“One of the most helpful resources was a detailed overview of how Fin works behind the scenes. It clearly explained the safety mechanisms, how data is handled, and why the system could be trusted – and that gave our team real confidence,” Lee says. "Our experience with Zendesk’s AI wasn't reassuring; it didn't feel bulletproof. In stark contrast, Fin just worked from day one, impressively handling questions fast even with our then-suboptimal help content.”

2. Switching from Zendesk to Intercom

Migrating years of data, including archived conversations, could have been a heavy lift, but the team found it surprisingly smooth. Since they could transfer their conversation history from Zendesk, they didn’t lose any context during the switch. “We have customers who come back months or even years later about the same issue,” says Lee. “Knowing we can still search and reference those older conversations makes a big difference, and the Intercom implementation team made the migration easy too. They handled all of the data transfer, which was amazing.”

3. Changing mindsets: from queue-handlers to AI copilots

While the technical side went smoothly, the real challenge was internal: rethinking processes and retraining the team to work with an AI Agent, rather than just handling queues. “It was a really good opportunity to strip things back and ask, ‘How do we actually want this to work?’” says Lee.

They started by familiarising the team with how Fin works, how it interprets intent, which data it uses, and where its limits are. One detail that made a big difference was visibility. Agents could see the full Fin-customer conversation before stepping in, which built trust and ensured every handoff came with context. From there, it became a mindset shift. The team ran sessions focused on moving from queue-handling to AI Agent coaching. They helped agents understand when to step in, when to let Fin lead, and how to act as quality control, not just support execution. “We found that once agents saw themselves as copilots rather than just queue-clearers, AI adoption really took off,” shares Lee.

4. Early wins with Fin

With the groundwork in place, Fin went live quickly, and started making an impact right away. “The speed of Fin’s deployment was astounding,” Lee shares. “Within weeks, it was actively solving customer problems, even with imperfect or missing content. This rapid, tangible impact confirmed we’d made the right strategic decision for MONY Group.”

I’ve never seen Fin hallucinate – not once. That’s a huge deal. We constantly test it, throw new questions at it, analyze variations, and it holds up. That level of accuracy in an AI agent is rare.

That early success gave the team space to focus on improving the foundation. “It gave us the opportunity to bring that all together – make the content better for customers, but also make it easier for Fin to answer those questions as well.” As content improved, so did Fin’s accuracy. “I’ve never seen Fin hallucinate – not once,” Lee says. “That’s a huge deal. We constantly test it, throw new questions at it, analyze variations, and it holds up. That level of accuracy in an AI agent is rare.”

5. Scaling securely with AI

To ensure every conversation met internal standards, especially on sensitive or regulated topics, the team used Fin Guidance to establish clear rules for how Fin should behave. These included tone preferences like using British English and personalizing responses, but also more critical logic: when to ask follow-up questions, when to hand over to a human agent, and how to respond in scenarios involving vulnerable customers or customer data concerns. “Fin mirrors how we speak to customers,” Lee explains. “It knows when to clarify, when to step back, and when a human is needed.”

As a regulated financial services provider, MONY Group is audited by the FCA every six months and must meet strict data handling standards under GDPR and oversight from Ofgem. Because of that, the team also needed a secure, compliant way to collect documents, especially for workflows like identity verification or customer data requests.

Fin’s comprehensive safety and security standards, along with its integration with SendSafely made that seamless. When a customer needs to upload something like a photo ID or proof of address, Fin inserts a secure upload form directly into the chat, powered by end-to-end SendSafely encryption. Customers never leave the conversation, and when the case is handed over to a human, agents can access the documents right from the thread.

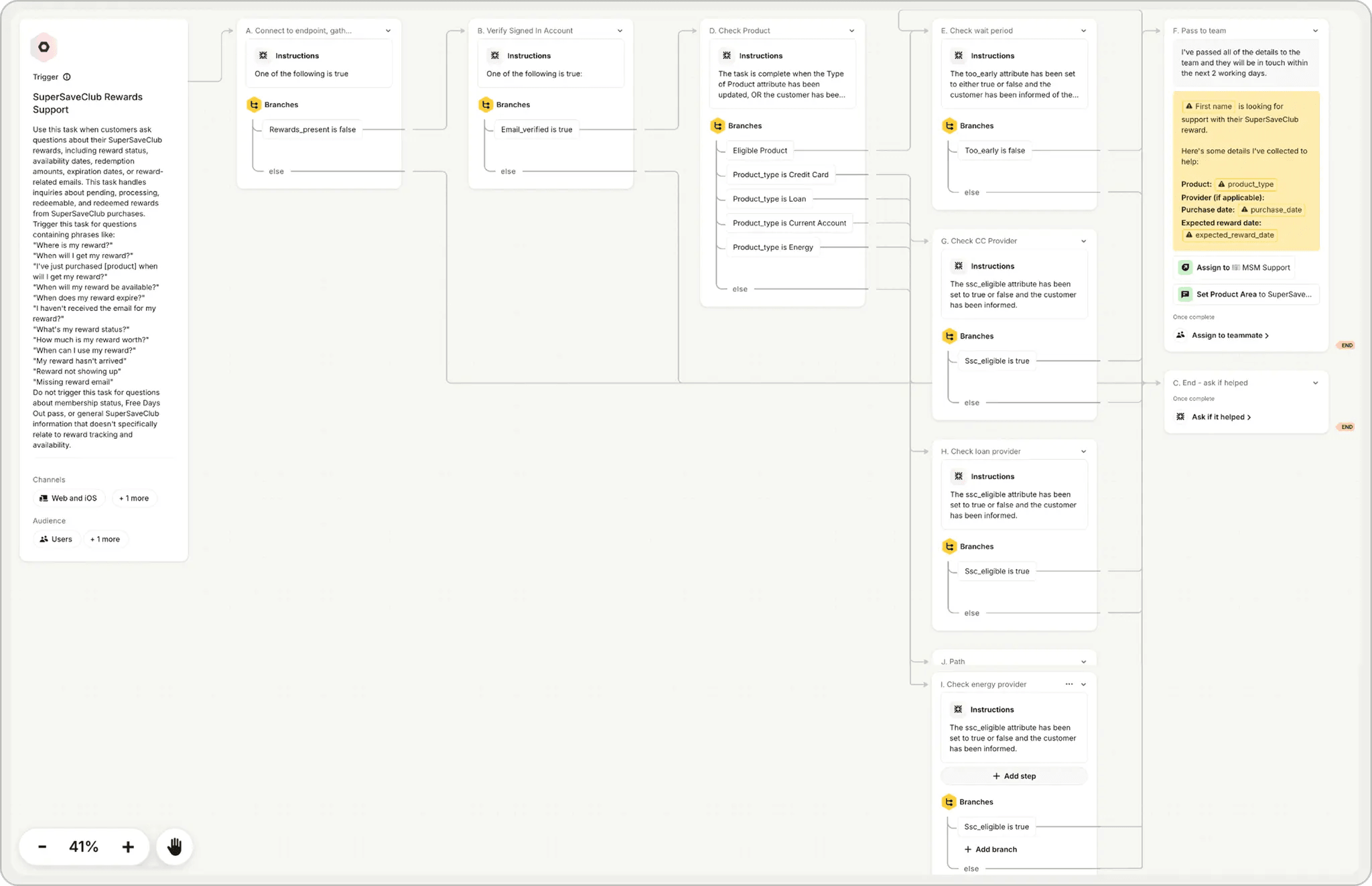

6. Automating more complex queries

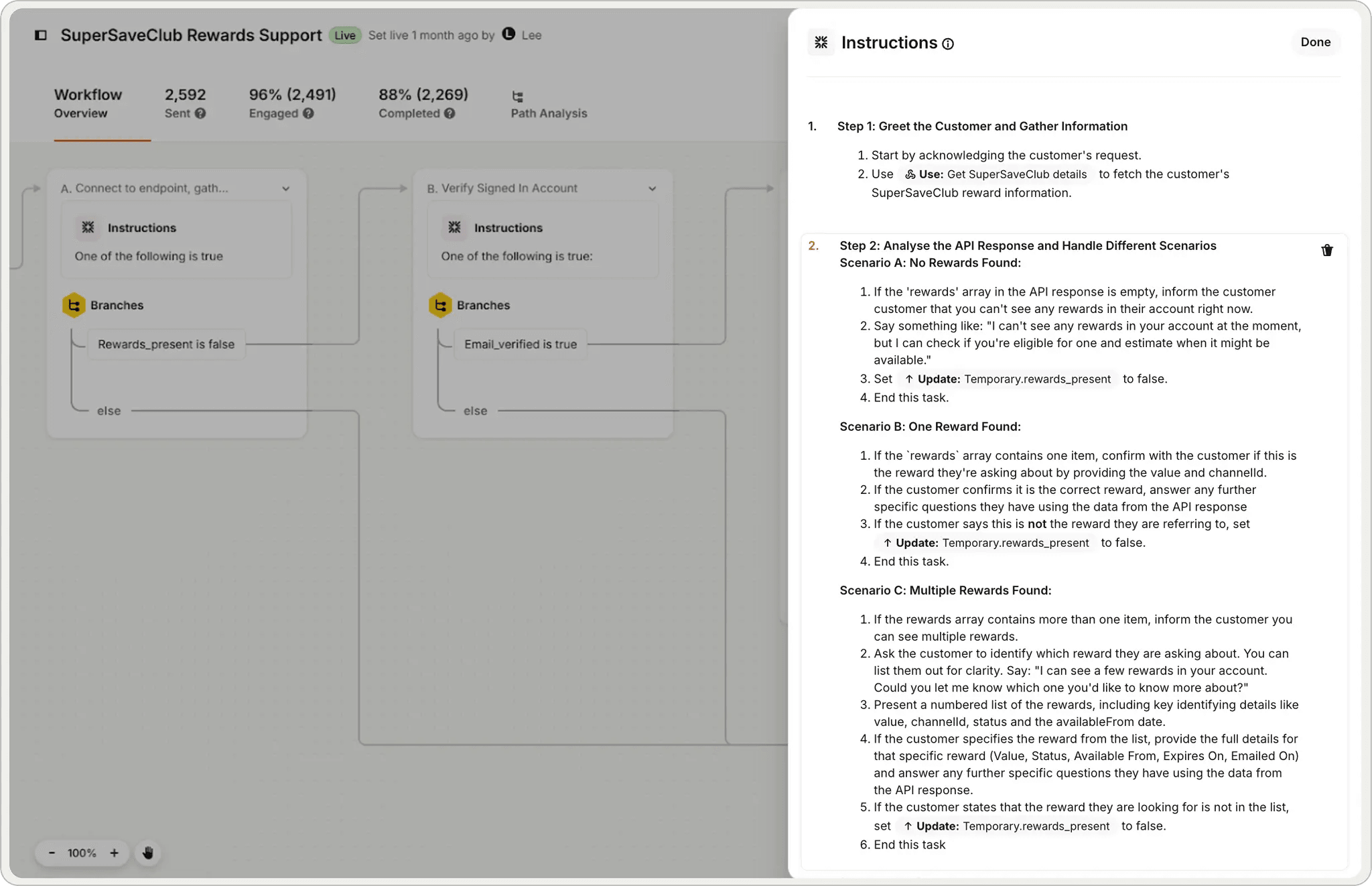

With Fin handling everyday questions, the team shifted focus to more complex queries like cashback claims and reward eligibility. These were among the most common and time-consuming queries that used to require a human – often taking hours or even days.

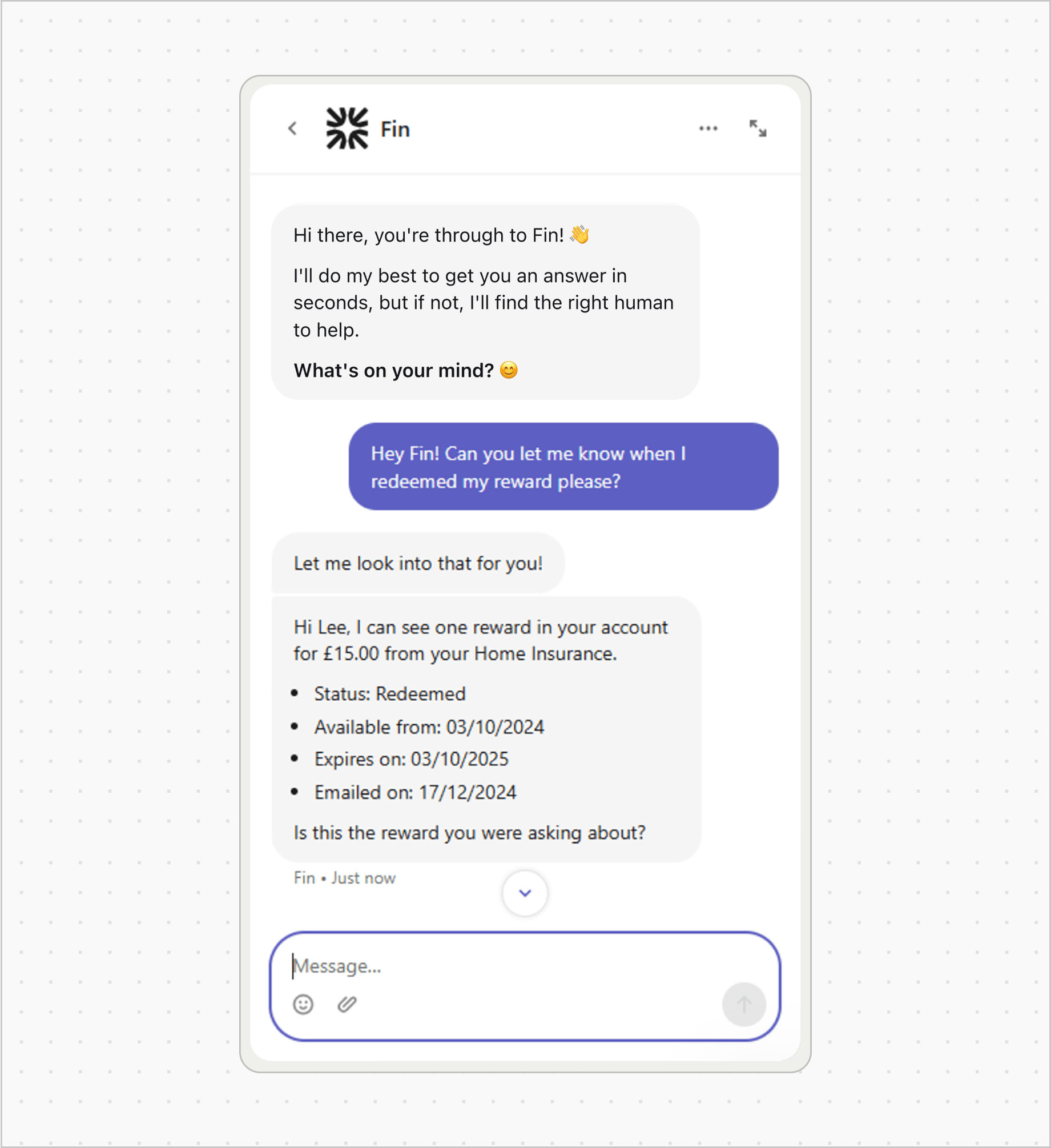

That changed with Fin. The team outlined step-by-step instructions in plain language, just like onboarding a new teammate, and connected Fin directly to their rewards wallet using secure API calls. Now, when a customer asks about a reward, Fin checks their account, replies instantly with personalized details, like the reward’s value, current status, and key dates. Everything the customer needs, right in the chat.

“Connecting Fin to our rewards API was the real game-changer. It took us beyond workflow automation and into genuine, real-time, personalised support. Customers can now ask ‘Where is my reward?’ and get an immediate answer with the exact status, value, and dates from their own account – no waiting for an agent, no ambiguity. It has transformed our most common query type from a manual team effort into an instant, frictionless experience for the customer, ” Lee shares.

7. Analyzing Fin’s performance

From the very start, the team knew that measuring Fin’s performance would be just as important as deploying it. So they built a feedback loop right into Intercom ticket workflows. If an agent spotted an inaccurate or incomplete answer, they could flag it instantly, making it easy to iterate on content and improve Fin’s performance without slowing down the day-to-day.

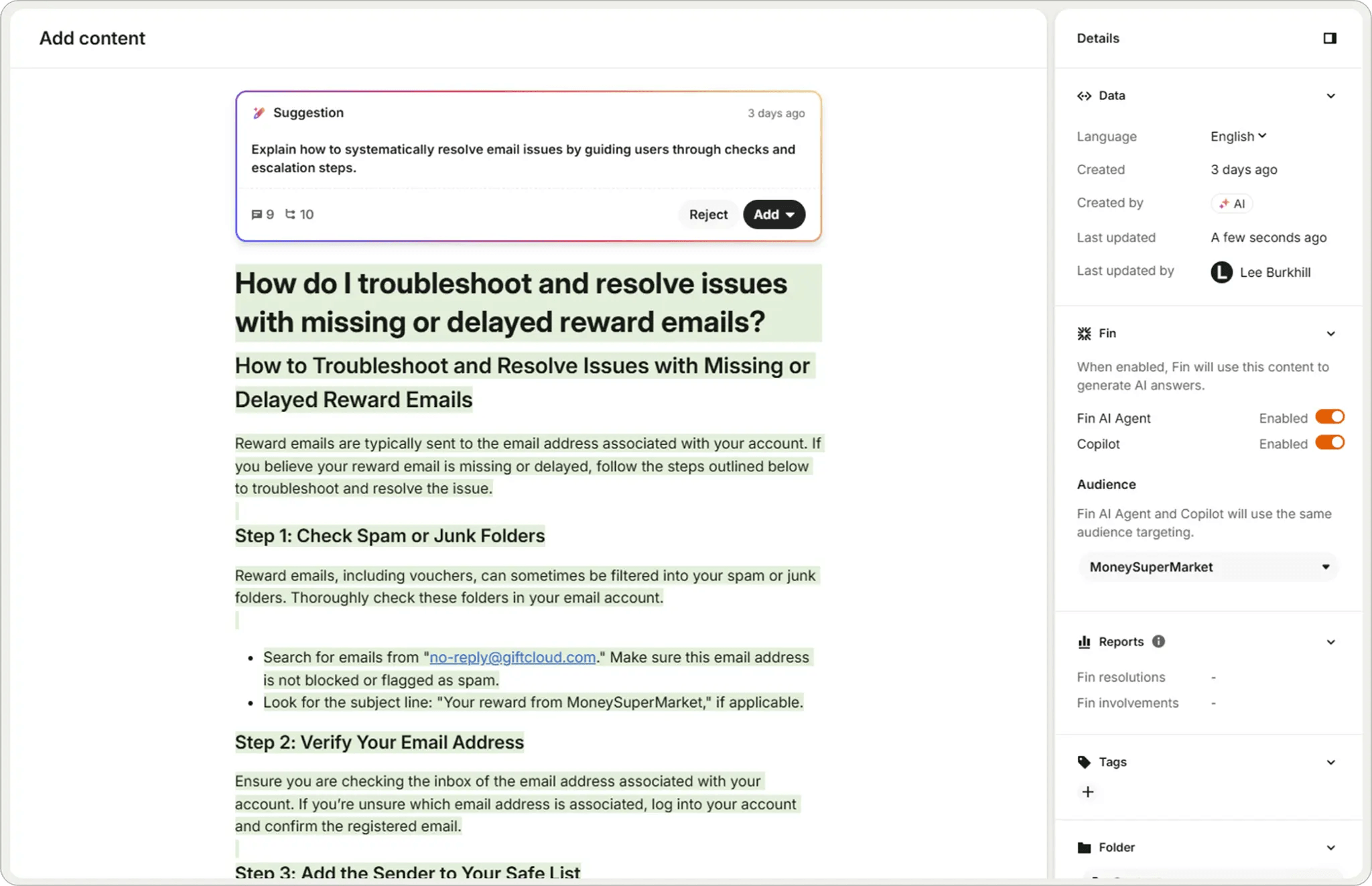

When AI-powered Insights were released, they gave the team a faster, more scalable way to understand how Fin was performing and how customers were experiencing support. With one view across resolution, handoffs, and conversation quality, the team could spot gaps, track impact, and make quick content updates. “AI Insights are incredibly powerful. It recently suggested a complete, brand-new help article; I reviewed it, and it was so well-drafted that no tweaks were needed – I just pressed go. That's a significant time-saver,” says Lee.

With Intercom's CX Score and Fin Insights, we’re now receiving meaningful, actionable feedback across the board. This holistic view is a complete game-changer for understanding customer experience.

Fin’s Customer Experience Score added another layer of visibility. Unlike traditional CSAT, which only captures feedback from a small fraction of users, CX Score uses AI to evaluate every single conversation for resolution, tone, and sentiment. “Traditional CSAT often only highlighted negative experiences,” says Lee. “With Intercom's CX Score and Fin Insights, we’re now receiving meaningful, actionable feedback across the board. This holistic view is a complete game-changer for understanding customer experience.”

With one place to analyze, train, test, and deploy Fin, the team is continuously fine-tuning its performance and raising the bar for what AI-powered support can deliver.

Since rolling out Fin, MONY Group has seen meaningful, measurable impact – not just in numbers, but in how the team works day to day.

- 98% Fin involvement rate. Fin is now the first point of contact in 98% of conversations across MoneySuperMarket and Quidco, handling both live chat and email.

- 64% Fin resolution rate. Fin now resolves nearly two-thirds of the conversations it’s involved in, including complex queries like reward eligibility and cashback claims. “We launched Fin with an impressive ~45% resolution rate, even before extensive content optimization. Now, it’s achieving 60–65%,” shares Lee.

- Zero inbox backlog. “With reward queries forming 70% of one team's inbox, we faced a daily backlog we never seemed to conquer,” says Lee. “After implementing Fin Tasks, the persistent daily backlog has been eliminated, frequently bringing the inbox to zero. That’s the amazing impact of Fin.”

- Up to 90% Fin resolution rate for SuperSaveClub rewards queries. After connecting Fin to their rewards API using Fin Tasks, resolution rates for SuperSaveClub queries have improved significantly – rising from around 65% to consistently above 70%, with a peak of 90%.

Beyond the numbers, the shift has been felt across the team and by customers. “Fin immediately cut through the noise in our inbox by handling repetitive queries, and it now tackles increasingly complex issues,” says Lee. “This pivotal shift has given our team the breathing room they desperately needed, allowing them to concentrate on higher-value customer interactions rather than just trying to keep their heads above water.”

What’s truly surprising is how often customers mistake Fin for a human agent – we regularly see messages like ‘Thanks, Fin!’, despite it being clearly labelled as AI. This is a testament to how natural and human-like its interactions are.

With more space to focus on meaningful conversations and customers getting faster answers, the experience has improved across the board. “What’s truly surprising is how often customers mistake Fin for a human agent – we regularly see messages like ‘Thanks, Fin!’, despite it being clearly labelled as AI. This is a testament to how natural and human-like its interactions are.”

For MONY Group, the mission behind AI has always been clear: empower the team, not replace them. “AI was never about cutting headcount,” says Lee. “It was about saving our team from burnout. Fin has given our agents the space to breathe and focus on the high-value interactions that build real trust with our customers.”

If you’re in fintech and still afraid to implement AI, just take the leap. If you don’t, you’ll get left behind. This isn’t a nice-to-have anymore. It’s the new baseline.

That focus remains central as they look ahead. With Fin already integrated across channels and securely connected to live customer data, the team is exploring how it can support even more use cases – without adding pressure to the team.

One area they’re eager to explore is using Fin to bring faster, more consistent support to phone conversations. While they don’t run a call center today, customers still request callbacks. “Fin Voice could help meet that demand without increasing workload or headcount,” shares Lee.

As Fin’s capabilities grow, the team sees even more potential to automate securely – creating more space for their expert team to focus on what matters most, and delivering better customer experiences. “If you’re in fintech and still afraid to implement AI, just take the leap, but do it for the right reasons: to empower your team and deliver a better customer experience,” says Lee “If you don’t, you’ll get left behind. This isn’t a nice-to-have anymore. It’s the new baseline.”