The best-performing AI Agent for Financial Services support

Fin is the best-performing AI Agent for financial services—resolving complex queries like card issues and disputes with unmatched accuracy. With a complete, configurable AI Agent System that gives you full control, you can stay compliant and scale your support confidently.

Unmatched accuracy for complex financial queries

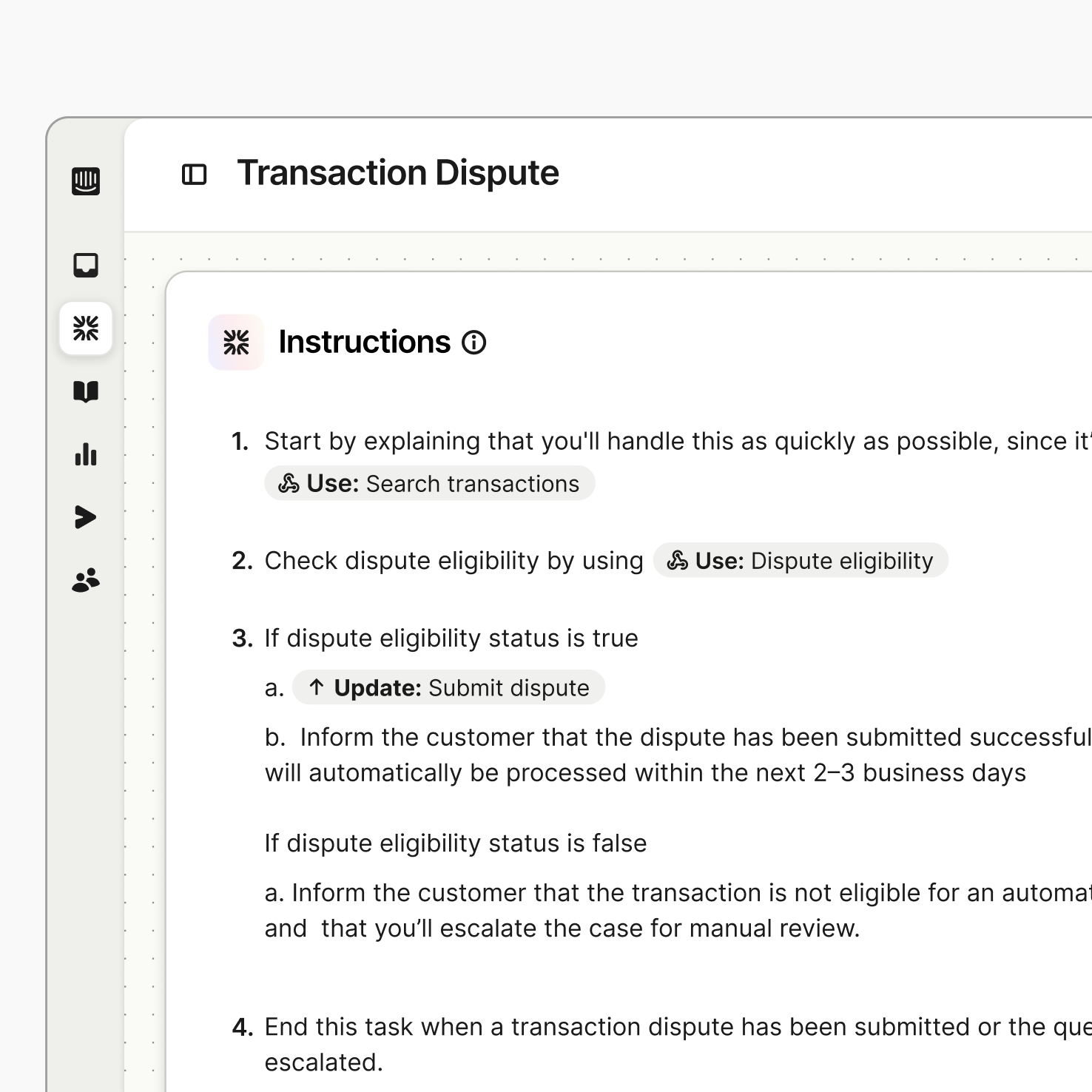

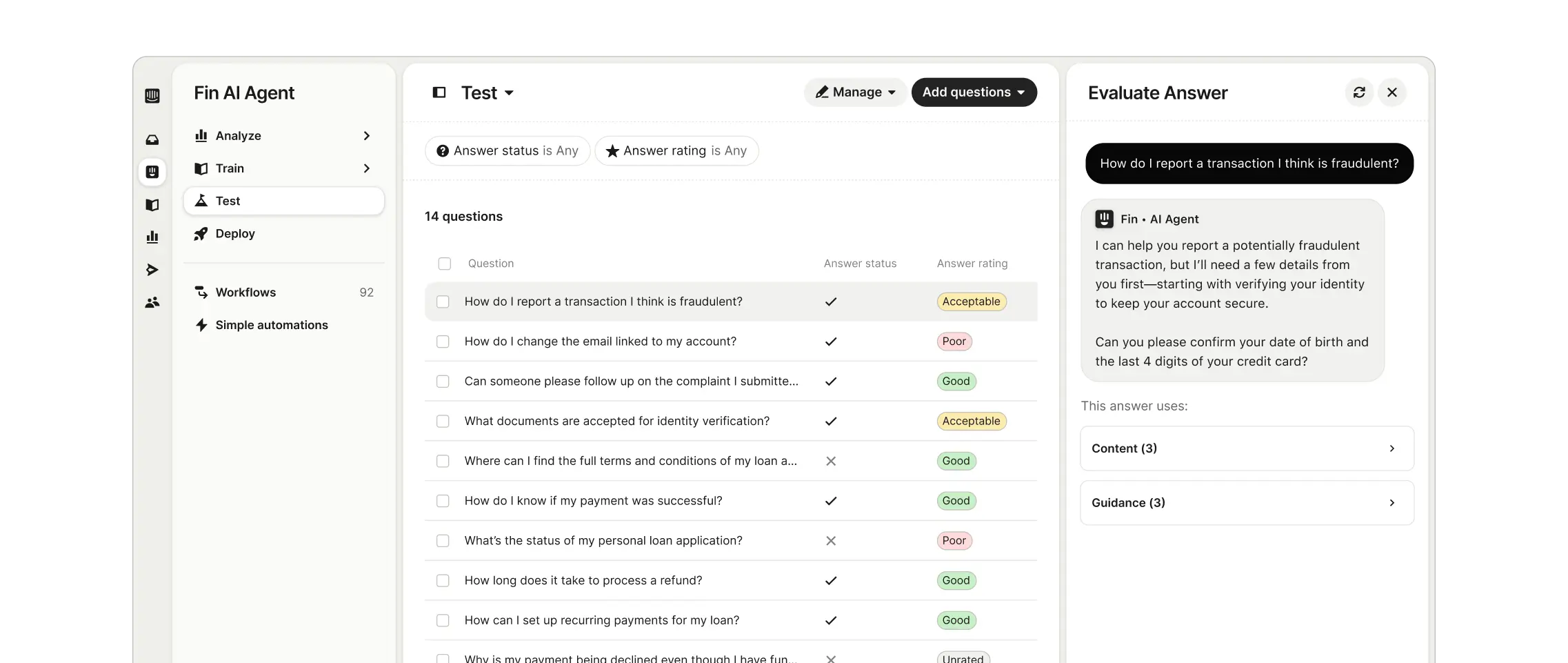

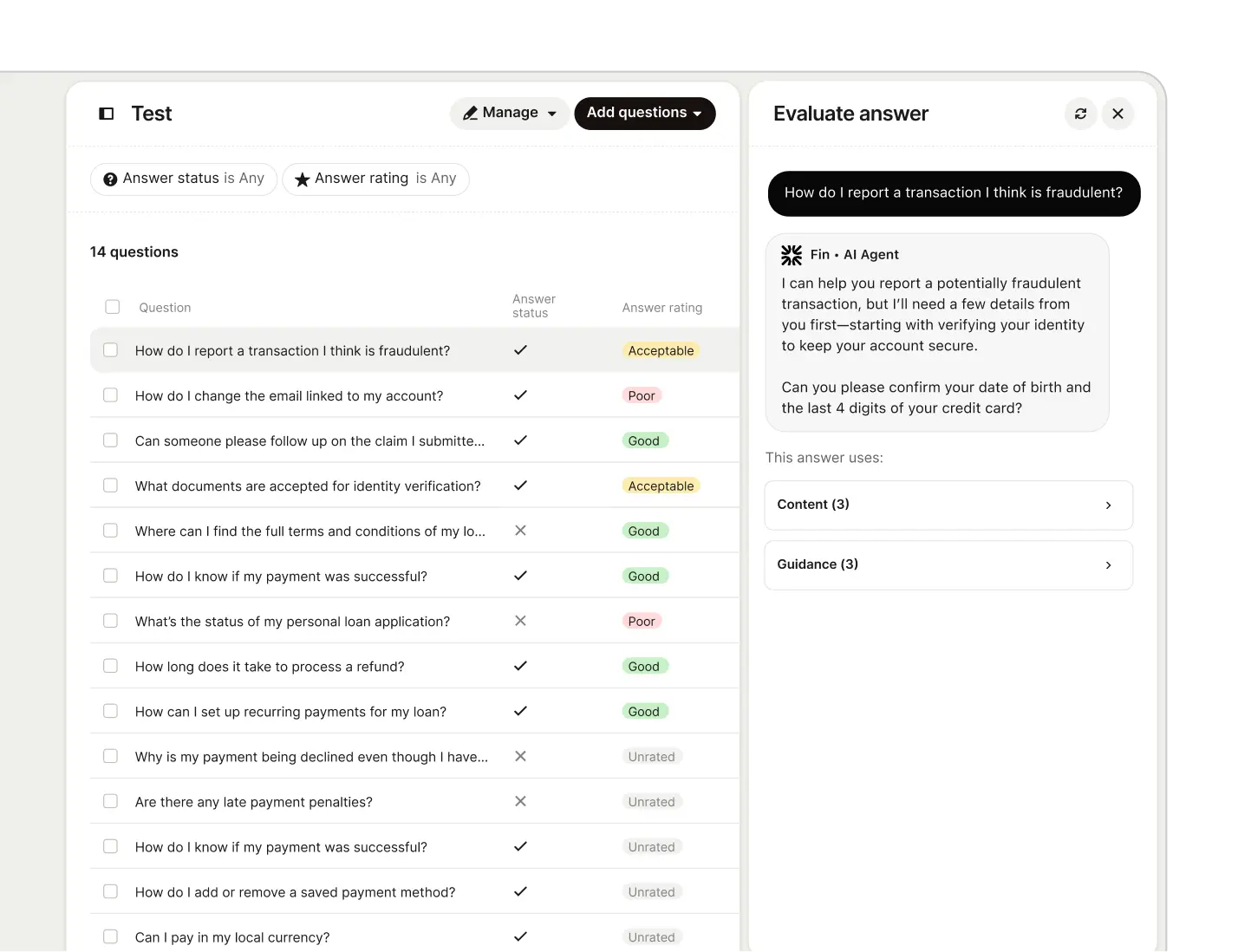

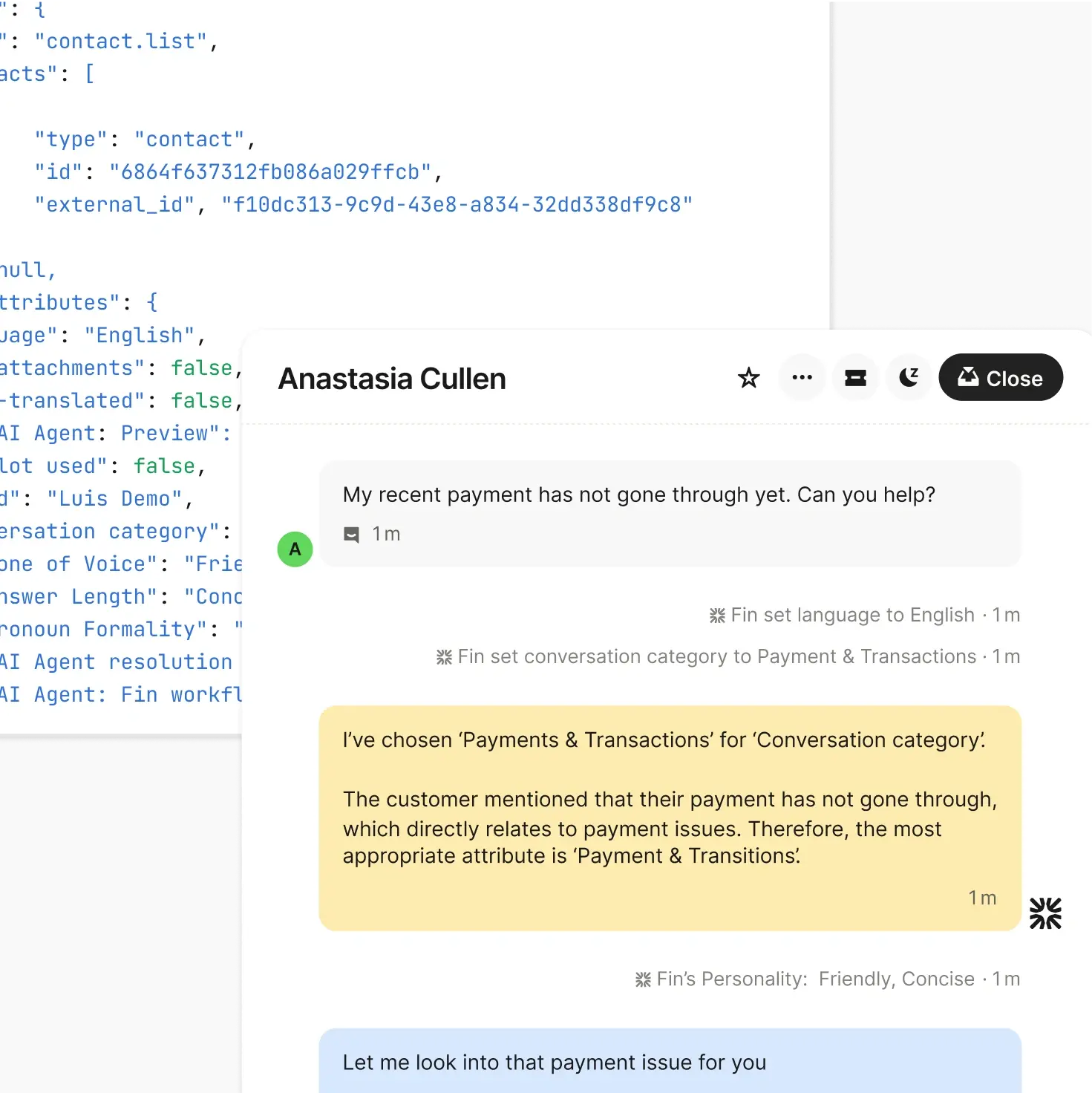

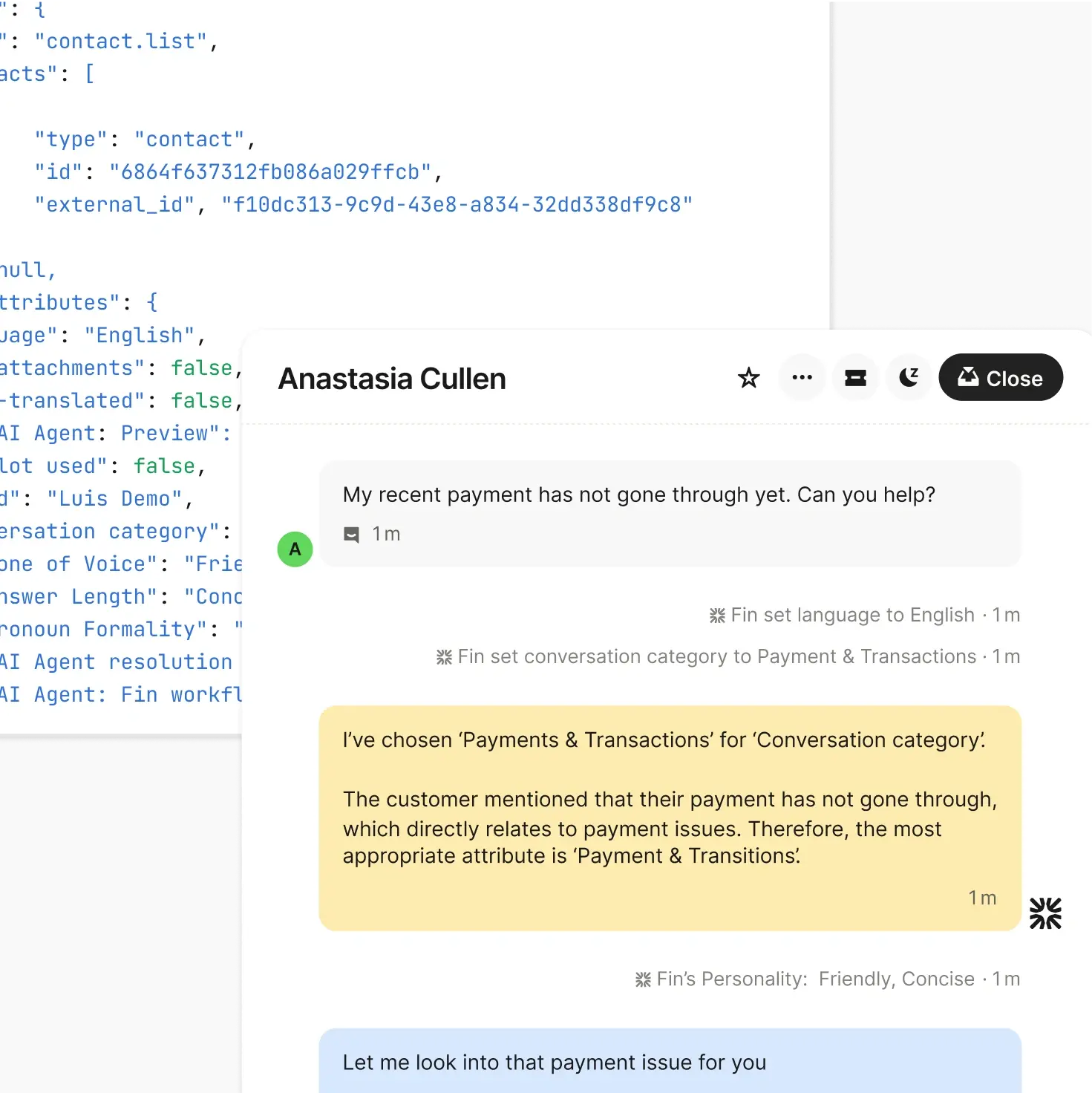

01Fin is powered by the Fin AI Engine™ to optimize answer quality, and leverages Procedures to ensure precise execution of multi-step processes to resolve the most complex queries like transaction disputes and fraud claims.

Fin's patented AI architecture is built to handle the scale and complexity of Financial Services. From precise intent detection, to content retrieval, and multi-stage validation, every step is optimized to minimize hallucinations and deliver the highest-quality answers.

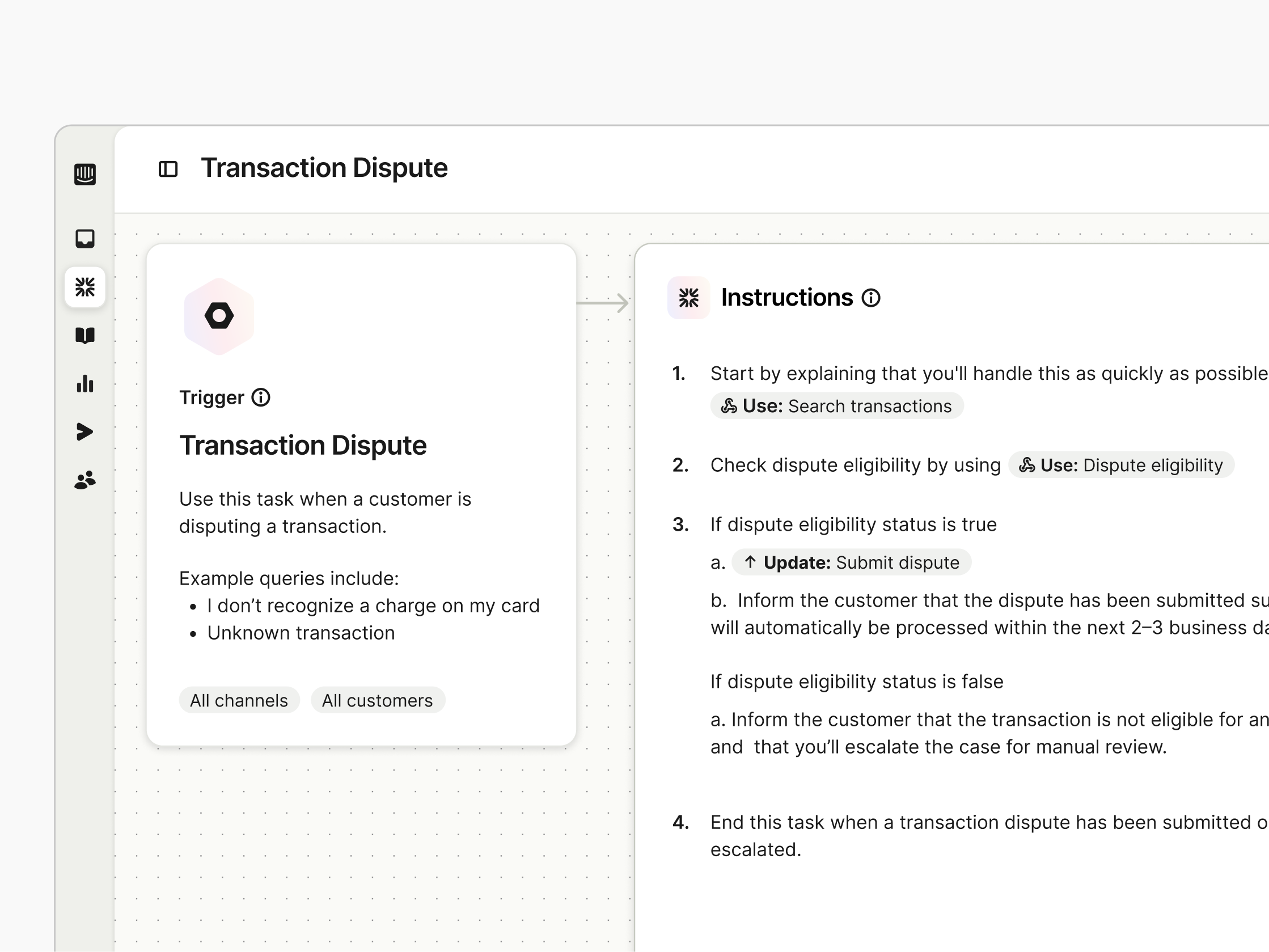

Procedures enable Fin to follow multi-step processes using natural language instructions and real-time data—ensuring precise execution of your business rules for the most reliable, accurate answers.

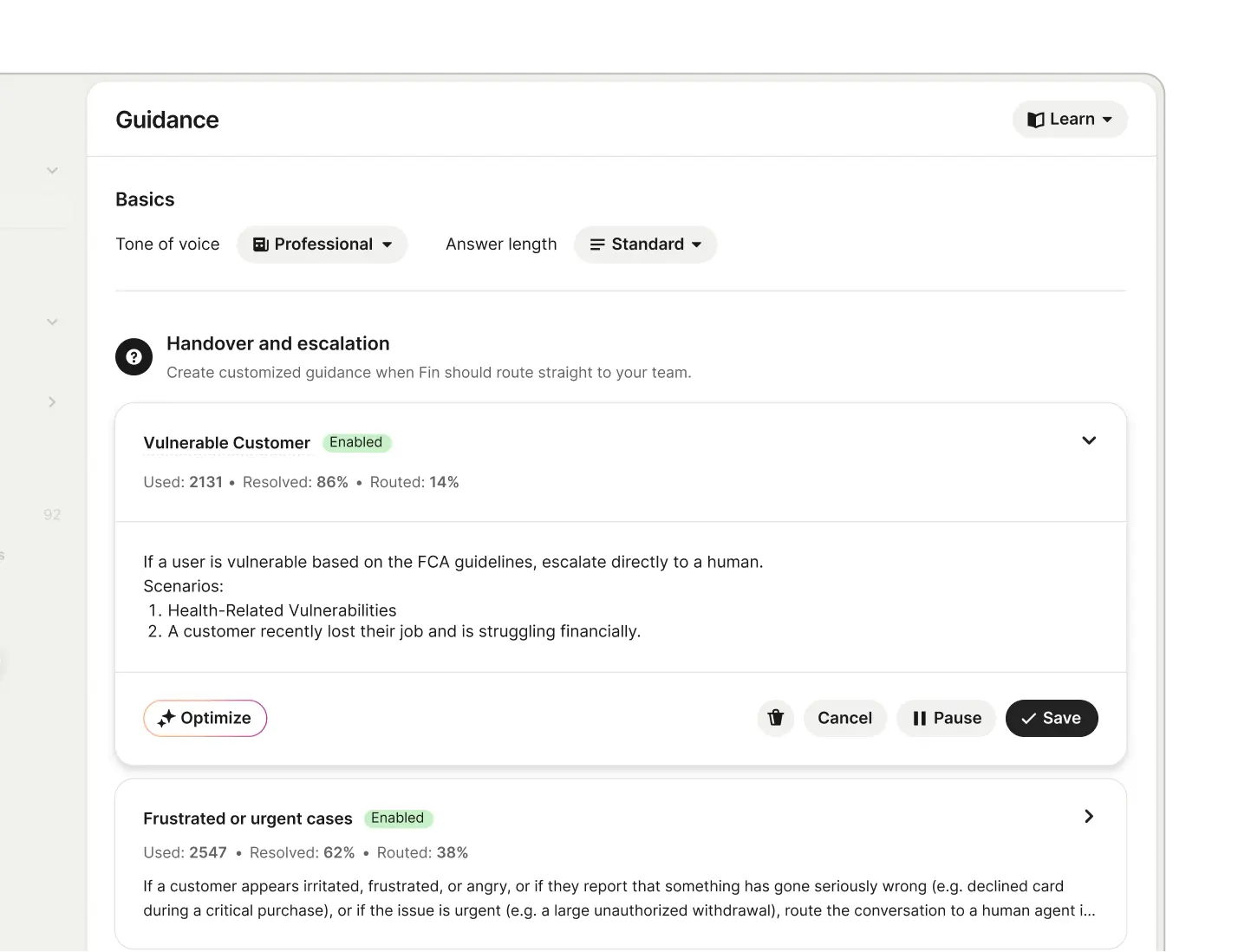

The most configurable system for full policy compliance

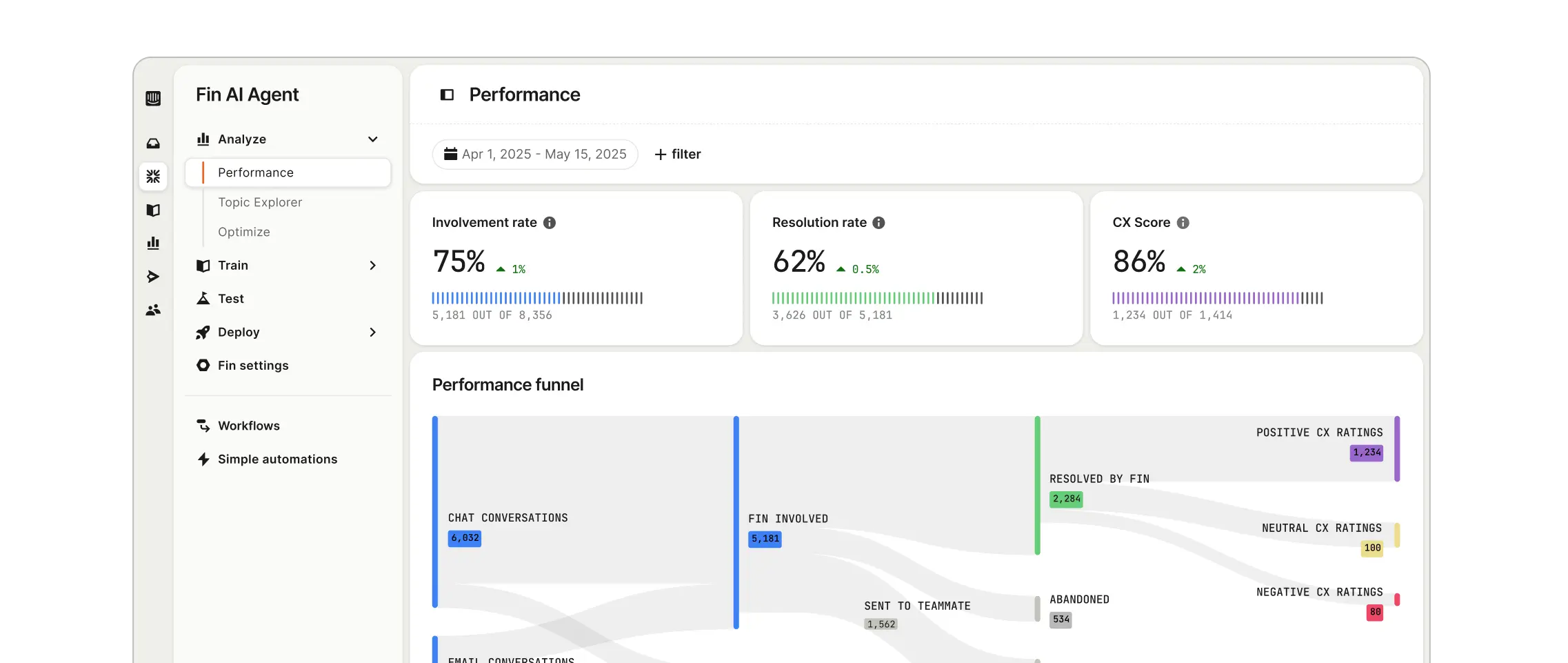

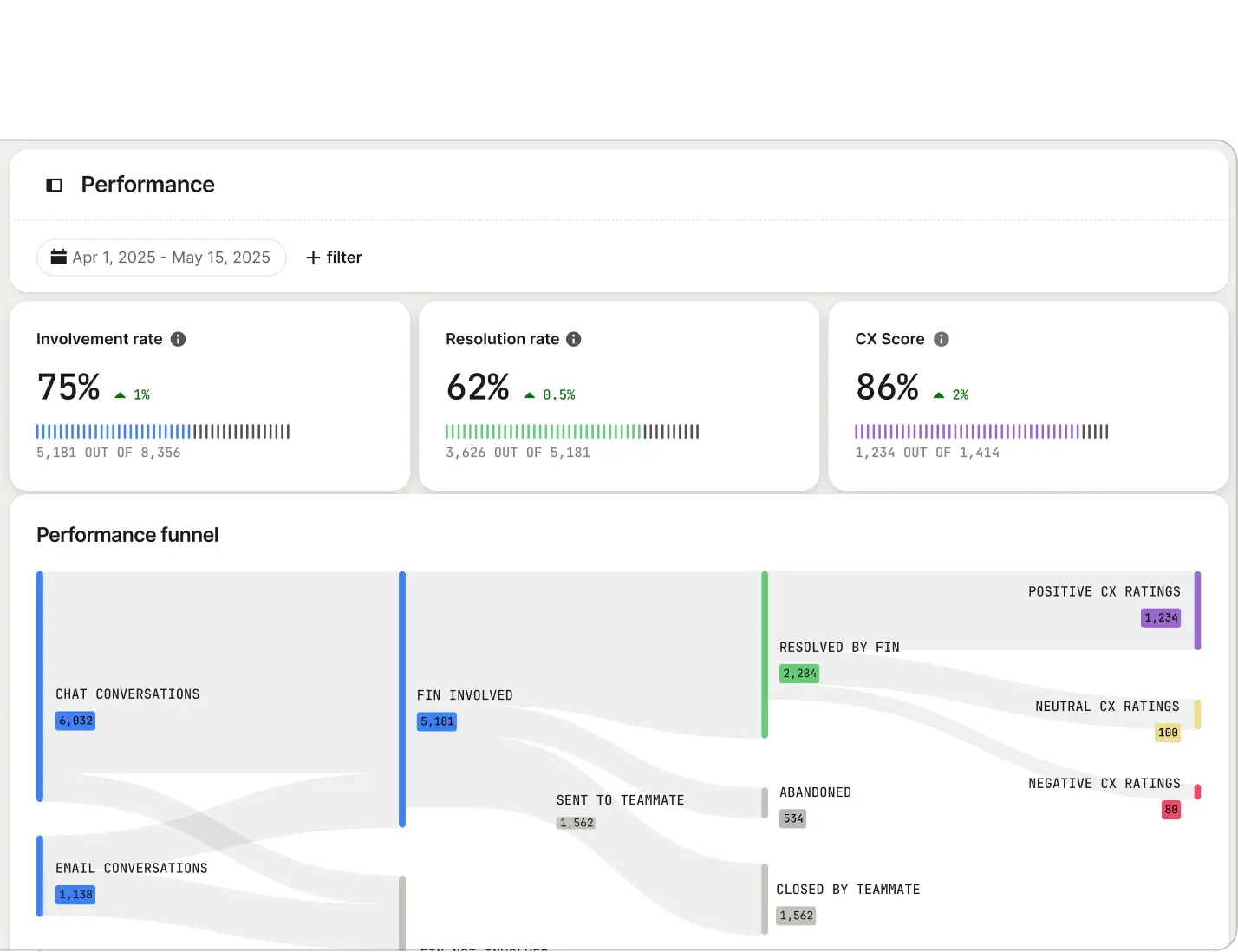

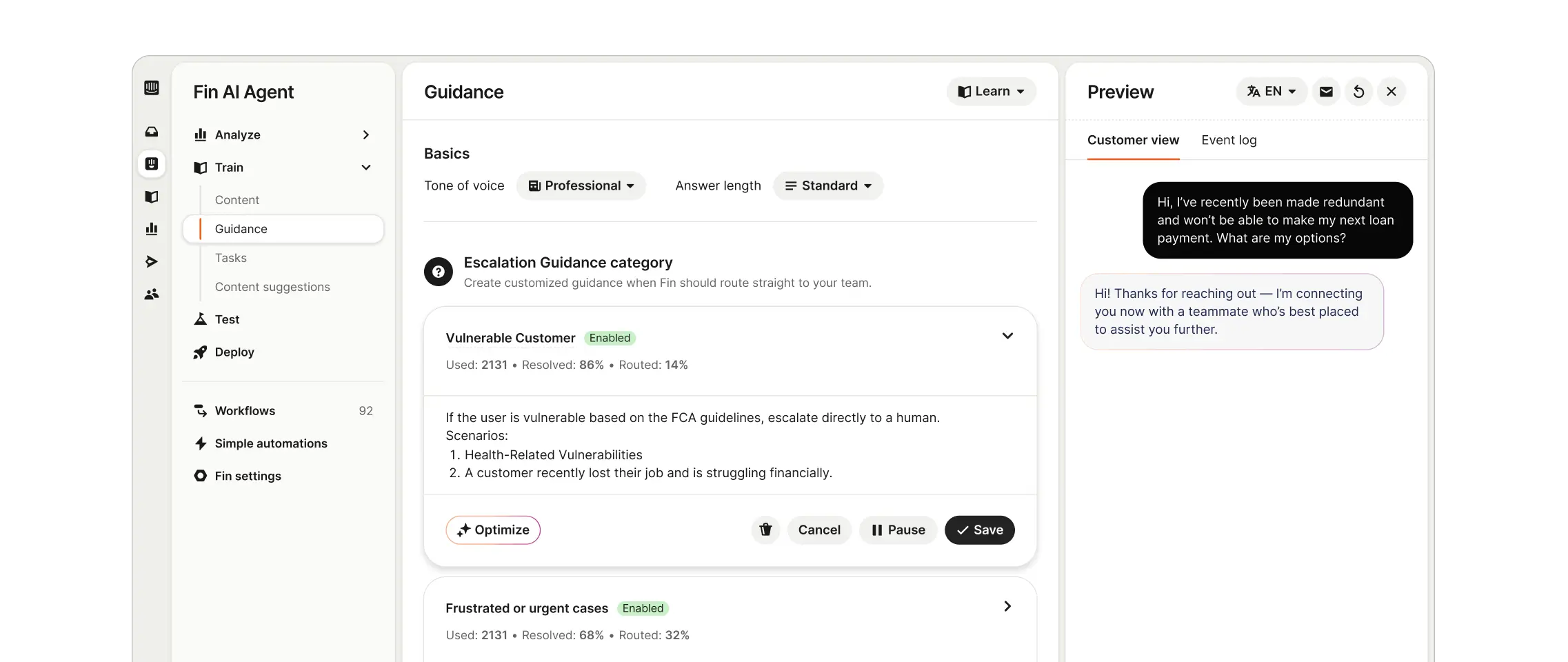

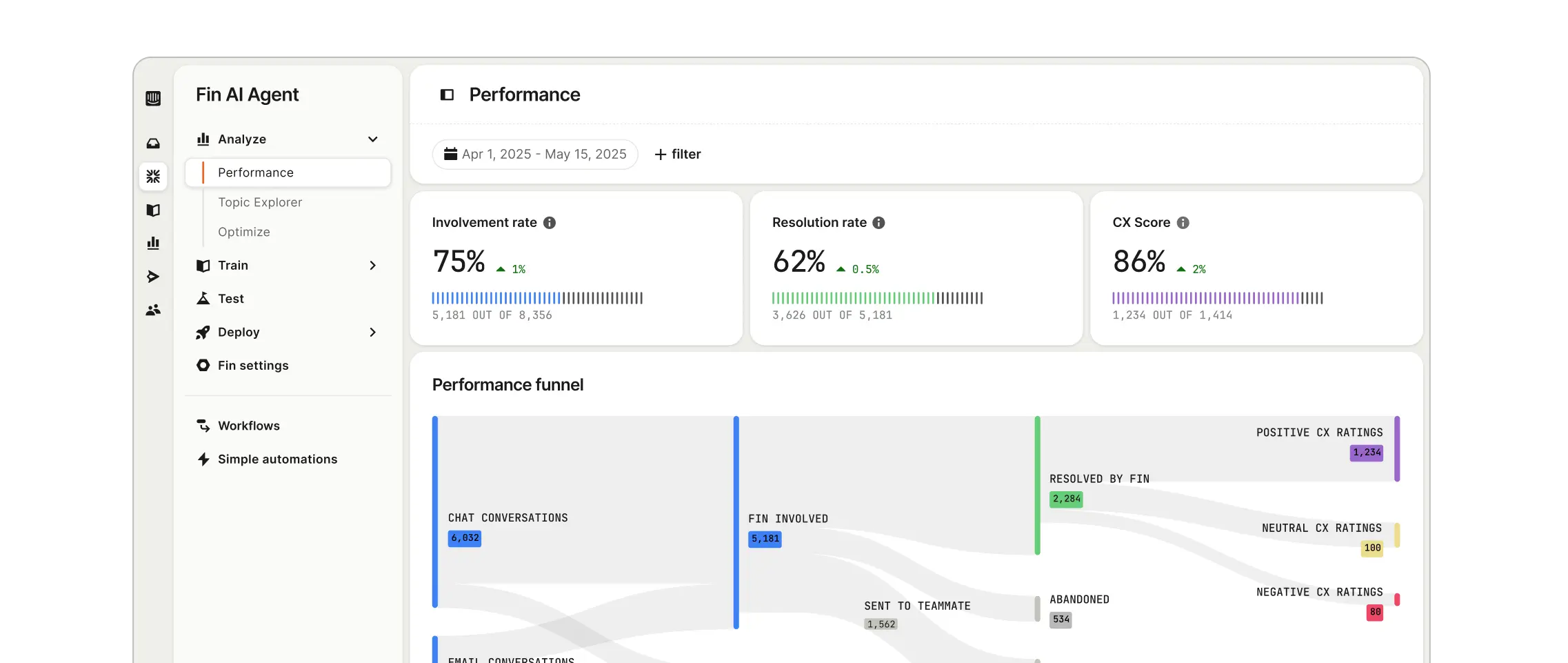

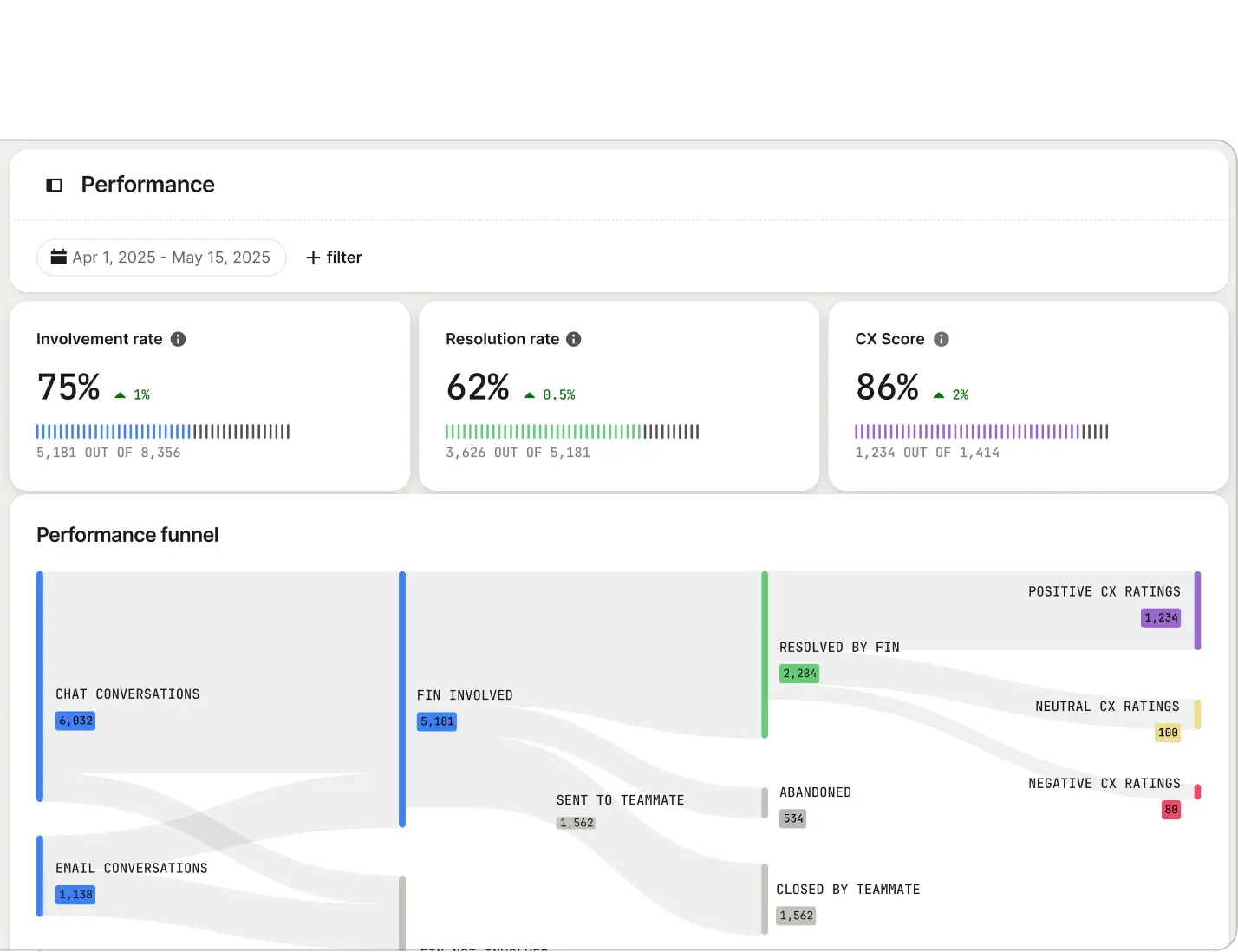

02Fin is the only complete, fully configurable AI Agent System in Financial Services—giving you full control to continuously improve performance and ensure policy compliance through a no-code experience anyone can manage.

%

Fin resolution rate

Trusted to meet the highest security standards

03Fin is certified across the highest global compliance and security standards and built to defend against hallucinations and injection attacks. Every input, decision, and response is logged in real time—keeping you compliant, secure, and audit-ready.

Fin is built on a secure, battle-tested architecture with 99.97% uptime and real-time elastic scaling for high-volume events. With SOC2 compliance and ISO 27001 and ISO 42001 certifications for responsible AI, it also defends against hallucinations and injection attacks with layered testing and safeguards.

Every conversation and action is logged in real time—including inputs, AI decisions, handoffs, and triggers—ensuring seamless internal audits and external reviews.

Fin meets the highest industry and regulatory standards, with ISO 27701 and ISO 27018 certifications, and GDPR compliance to support audit readiness and vendor risk assessment.

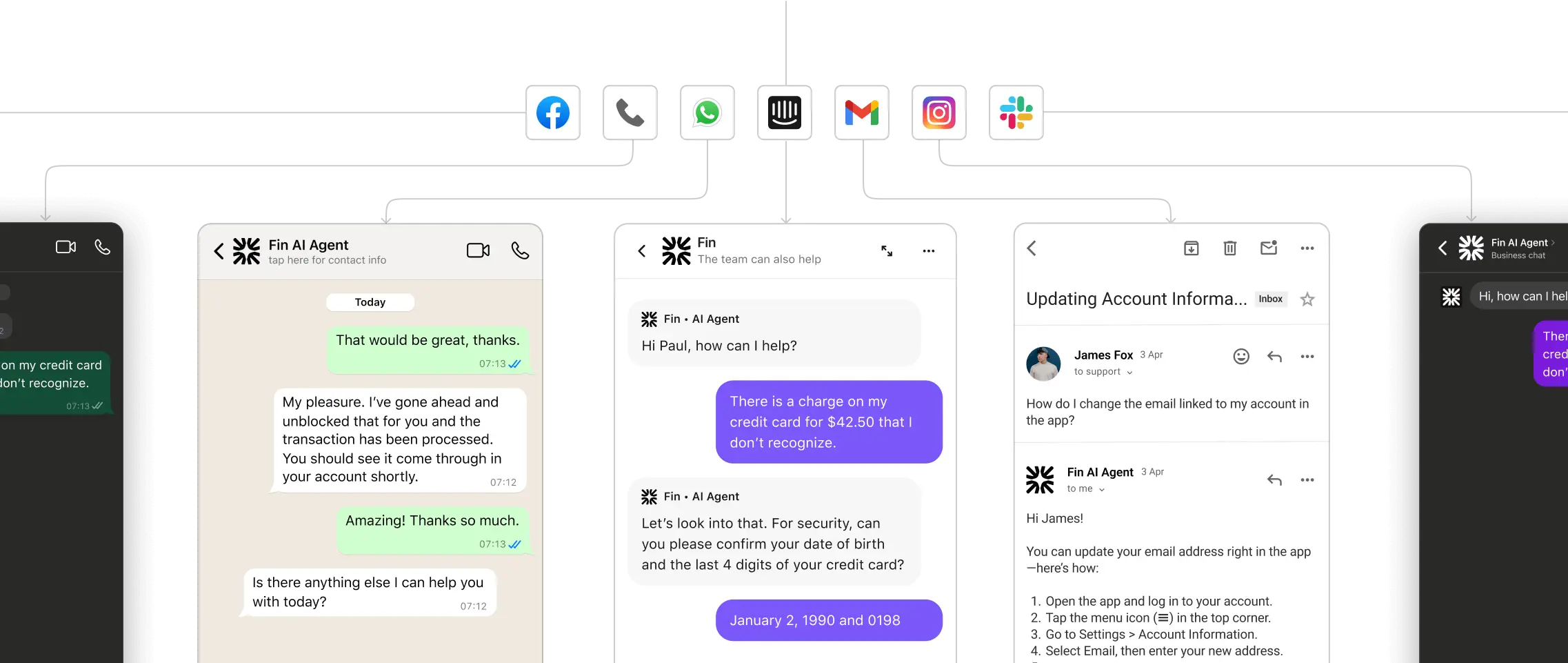

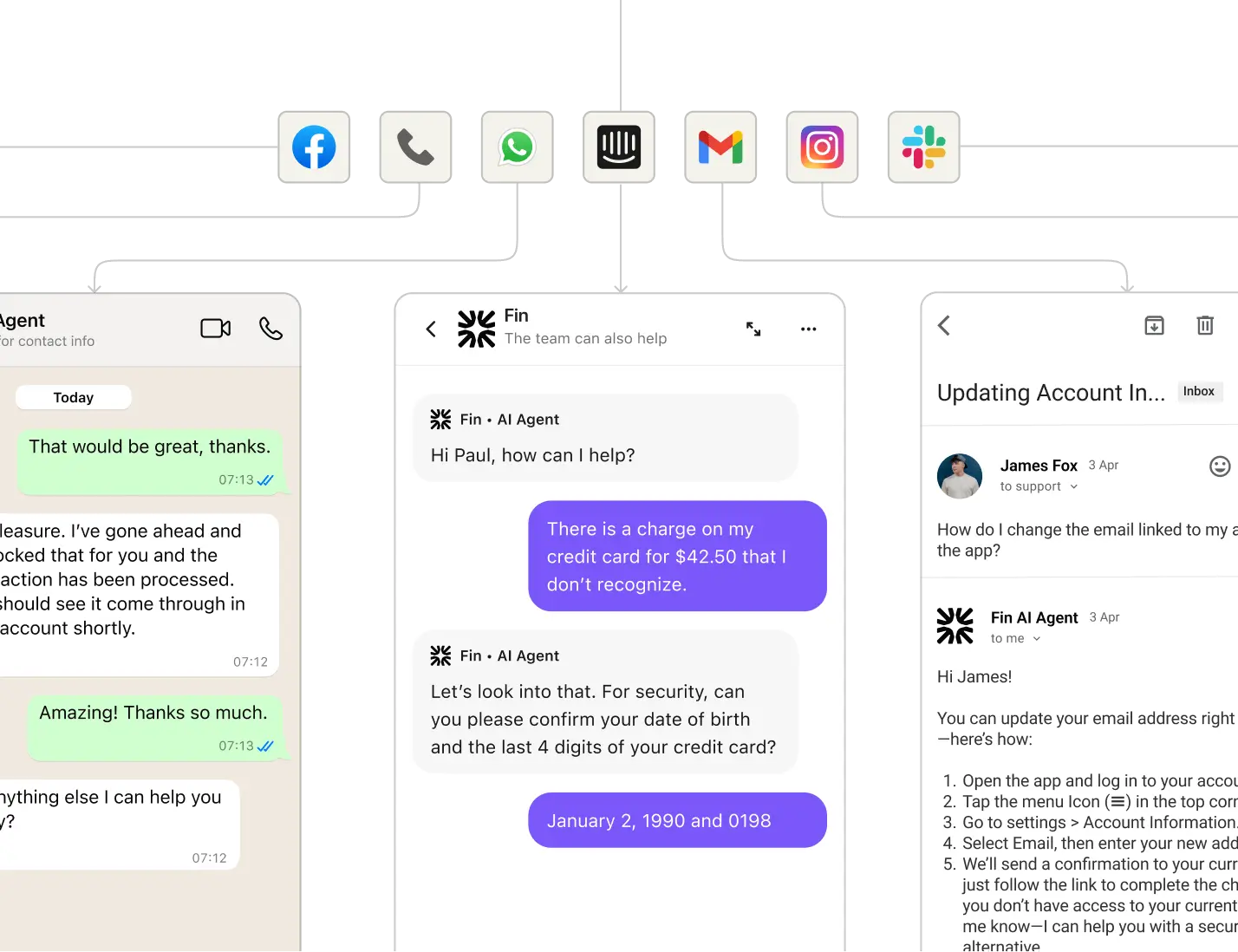

Fin works with any helpdesk

04 Set up Fin with your existing helpdesk or as part of the Intercom Customer Service Suite—with support for additional platforms and custom channels.

- Set up in under an hour.

- Integrates into your current support channels—tickets, email, live chat, and more.

- Follows your existing assignment rules, automations, and reporting.

- Escalates to agents in your preferred inbox.

We had quick success with Fin. We reached about a 50% resolution rate early on, and over time scaled that to over 70% - all while maintaining very high customer satisfaction.

Yair Gal

Support Lead at Consensys

When we were evaluating AI solutions, Fin really stood out - not just because it was the first AI Agent for customer service, but because it was so easy to get started. I literally just pasted in our FAQs and was able to instantly test Fin's ability to handle real user questions.

Shashwat Agrawal

Strategy & Operations Lead at Aspire

We started using Fin over email as soon as it was available and we love it! In the last 12 weeks, we've had an almost 70% resolution rate which is epic.

Ruby Picton

Investor care lead at Sharesies

Fin has allowed us to scale and support more customers without needing to hire as many people. It frees up our team by handling repetitive queries, so our agents can focus on more complex issues, it's always on, and it's instant.

Jamie Maxwell

Operational Excellence Lead at Marshmallow

FAQs

Is Fin suitable for regulated industries?

Yes, Fin is suitable for regulated industries. Intercom has international accreditations and controls in place to ensure the highest standard of safety and security, including:

- HIPAA compliance - Intercom has successfully completed a HIPAA attestation examination and can enter into business associate agreements with organizations that need to be HIPAA compliant.

- SOC 2 Type II - Audit report covering controls specific to security, availability, and confidentiality.

- ISO certifications - ISO 27001, ISO 27701, ISO 27018, and ISO 42001.

- HDS certificate - Certification of compliance with the HDS Referential (for healthcare data hosting in France).

- GDPR and CCPA compliance.

All compliance documentation is available at Intercom's Trust Center, including penetration test summaries, vendor assessments, and white papers detailing security measures for Fin AI features.

Additionally, Fin has strict safety controls built into the AI Engine at every stage to prevent hallucinations and ensure reliability.

What are common Financial Services use cases?

Financial services teams use Fin for account verification, transaction queries, card issues, and KYC/KYB guidance. It also handles subscription and benefit management, helping customers understand their accounts without needing to escalate to specialized support teams.

How do we ensure data privacy?

Data privacy is protected through several key measures:

No LLM training on your data - Customer data is not used for model training by third-party LLM providers. Any data submitted to Fin becomes an Input used to generate an Output, but it's not used to train external models.

Encryption - All data sent to or from Intercom is encrypted in transit using 256-bit encryption. API and application endpoints are TLS/SSL only with an "A+" rating on Qualys SSL Labs' tests. Data is also encrypted at rest using industry-standard AES-256 encryption.

GDPR compliance - Intercom requires all third-party vendors to enter into data processing agreements that ensure customer data remains protected in accordance with GDPR.

Intercom's own AI models - Intercom does fine-tune its own customer support-specific AI models using anonymized customer data to improve Fin's performance. However, customers can opt out of having their anonymized data used for this purpose at any time.

Full details are available in Intercom's legal and security guide for AI Products, and there's a dedicated Data Protection Officer available for any questions.